StandX Vault & SLP

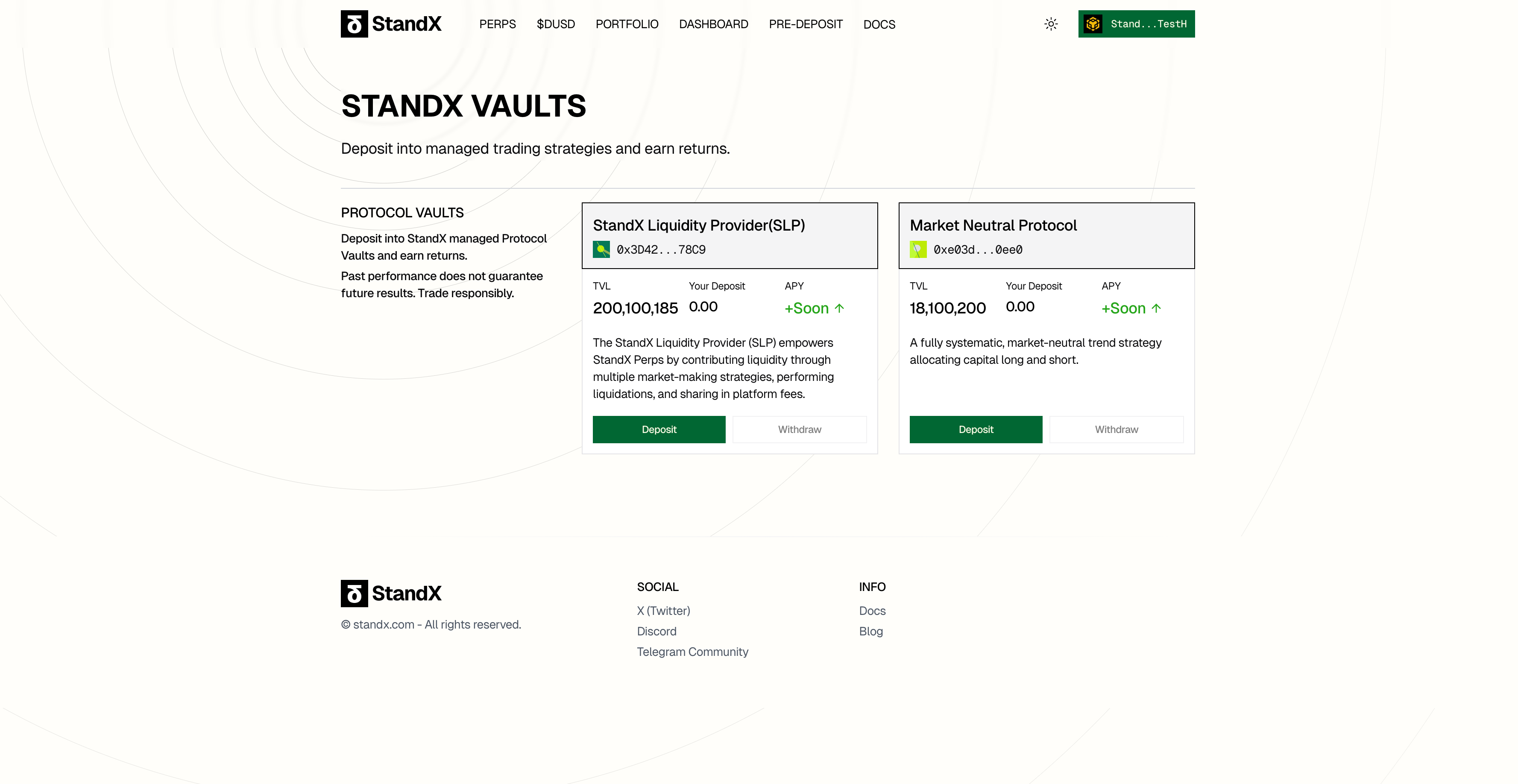

StandX Vaults allow you to deposit assets into managed trading strategies to earn returns. Our vaults are designed to be transparent, powerful, and accessible. Initially, we are launching with our core Protocol Vault.

Protocol Vaults: The StandX Liquidity Provider (SLP)

The StandX Liquidity Provider (SLP) vault is a system-level vault designed to power the StandX Perps exchange.

-

How it Works: By depositing funds, you contribute liquidity that supports the platform’s ecosystem. The vault generates returns through a combination of sophisticated market-making strategies, performing liquidations, and sharing in a portion of the platform’s trading fees.

-

Profit Distribution: As a protocol vault, it operates for the benefit of its users. The vault itself does not take a percentage of the profits. All net returns are periodically distributed among the liquidity providers.

-

Claiming Yield: Your bonus Vaults yield is displayed underneath ‘Extra Yield’. This is extra yield from DUSD yield, derived from funding rates and staking rewards. You can claim it manually at any time. This extra yield sits on top of your Vault SLP returns, which come from market making, liquidations, and protocol revenue.

Your extra $DUSD Vaults yield is now visible.

This is bonus yield on top of base DUSD yield from funding rates and staking rewards. You can claim it manually at any time. These earnings sit on top of your Vault SLP returns, which come from market making, liquidations, and protocol revenue.

The SLP Token

When you deposit into the vault, you receive SLP tokens.

- A Share of the Vault: The SLP token represents your proportional share of the vault’s Total Value Locked (TVL).

- Fluctuating Value: The price of one SLP token is calculated by a simple formula:

SLP Price = Vault TVL / Total SLP Supply. Its value will increase or decrease based on the performance of the vault’s underlying trading strategies.

Deposits & Withdrawals

To ensure stability and effective capital deployment, the SLP vault operates on the following timelines:

- Deposits: All deposits are settled and put to work after a T+4 period (four business days).

- Withdrawals (Up to T+4):

- If the vault has sufficient idle (undeployed) funds, withdrawal requests are processed instantly.

- If the vault’s funds are actively deployed and used in trading strategies, withdrawals may take up to a maximum of T+4 as capital is freed up.

Deposits & Withdrawals

Coming Soon: User Vaults

In the future, StandX will introduce User Vaults. These will differ from Protocol Vaults in a few key ways:

- Vault Leaders: Each vault will be managed by an independent strategist, or “Vault Leader,” who designs and executes the trading strategy.

- Performance Fees: Vault Leaders will earn a percentage of the profits (PnL) generated by their strategy as a performance fee.

- Shared Risk & Reward: When a vault is profitable, depositors share the returns after the leader’s fee. If the vault incurs a loss, the loss is shared proportionally among all depositors.