StandX Perps Overview

Margin Yield with DUSD

Our platform supports using DUSD, a yield-bearing stablecoin, as margin for perpetual trading. Traders not only gain access to leveraged positions but also earn real onchain yield on their trading margin, maximizing capital efficiency. This design combines the benefits of stable yield and flexible trading, offering users a more attractive, yield-enhanced trading environment.

Built by the ex-Binance Futures Founding Team

This project is built by the core members of the original Binance Futures founding team, bringing deep expertise in derivatives platform architecture and risk management. Before launch, the platform secured institutional-grade liquidity and was designed from the ground up with a high-performance matching engine and robust risk management systems to meet the demanding requirements for speed, stability, and security.

UI Innovation and Design Philosophy

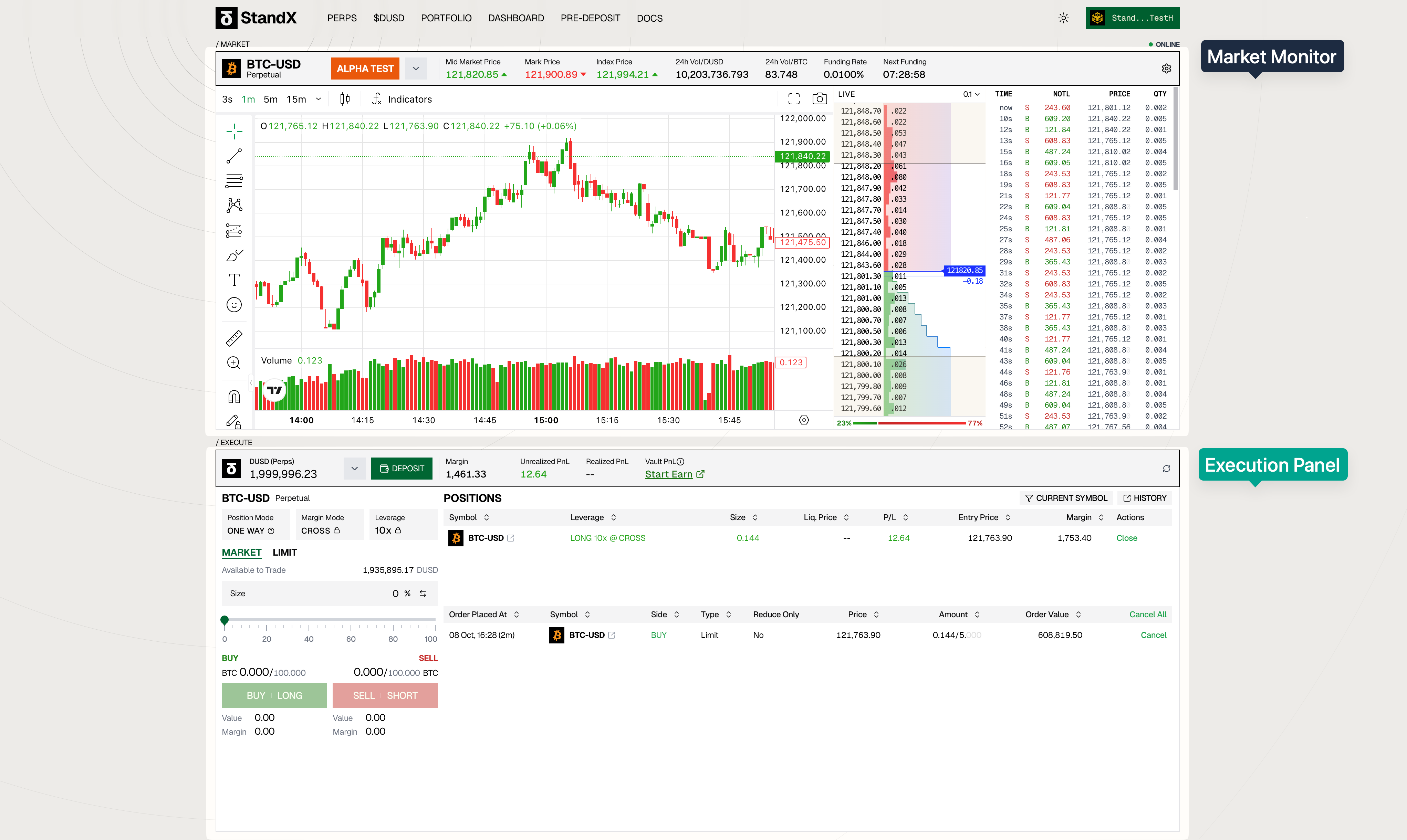

The StandX Perps user interface is designed to provide traders with a seamless and intuitive experience, balancing comprehensive market data with swift trade execution. The layout is inspired by the game of poker, dividing the interface into two primary sections:

- The Market Monitor - the poker table.

- The Execution Panel - the player’s hand.

This analogy forms the core of our design philosophy: the Market Monitor is the shared space where all public information—the flow of the game, the size of the pot, and the community cards—is displayed for all to see. The Execution Panel is your private domain, where you hold your cards, assess your strategy, and make your move.

Perpetual Contracts on StandX

StandX’s perpetual contracts are denominated and margined in DUSD, a yield-bearing stablecoin issued by StandX. This design allows users to earn on their margin while trading, significantly improving capital efficiency by combining stable returns with leveraged trading.