Redeeming DUSD

Redeeming DUSD is the process of returning your DUSD to the StandX system in exchange for base assets (e.g., USDT, USDC).

Key highlights:

- Flexible Redemption: You can redeem DUSD regardless of where you originally acquired it—whether minted, purchased from a DEX/CEX, or received from another user.

- Secure and Transparent: The process is fully automated and powered by smart contracts to guarantee the safety and accuracy of your redemption.

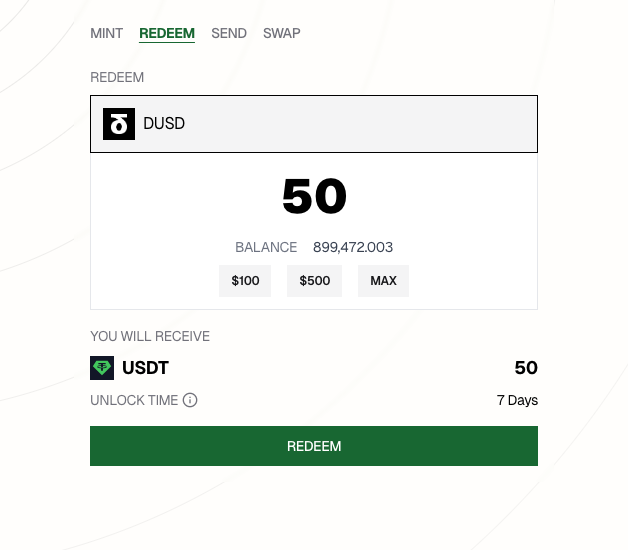

Redemption Steps

1. Order Creation and Signing

Users generate a transaction specifying:

- Amount of DUSD to redeem

- Desired collateral asset to receive

The StandX server validates: User’s DUSD balance and order signature authenticity. While StandX can reject orders based on these conditions, it cannot modify the signed order parameters

2. Lock time

There is 7 days lock time for redemption, while this is a very common setup in most crypto protocols, the main reason for StandX is the system needs time to quit the hedging positions and anti-hack cyber security consideration.

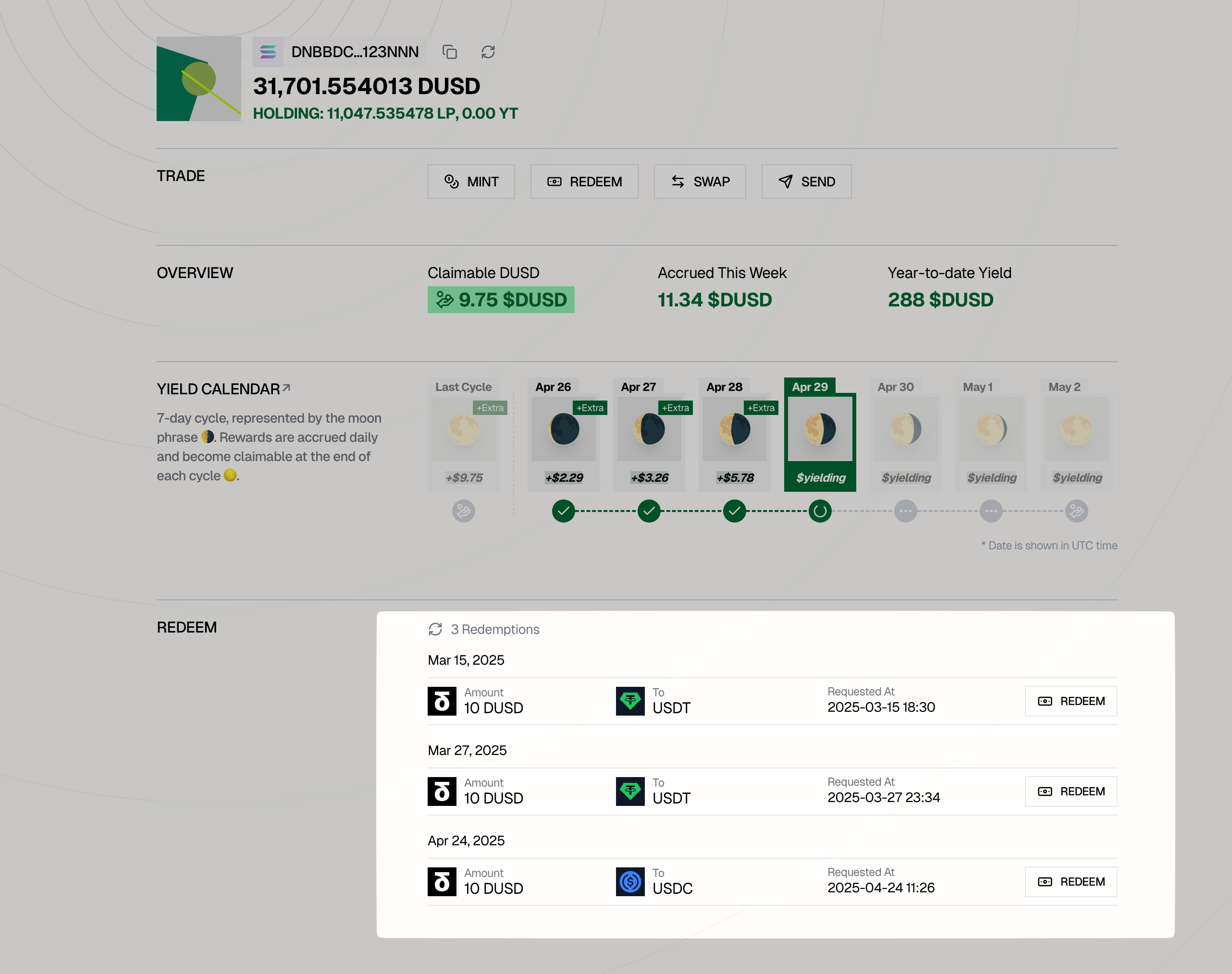

3. Settlement Completion

- Visit the https://standx.com/portfolio and click the Redeem button to complete the redemption process

- The protocol’s reserve management system adjusts positions to maintain optimal collateral ratios

- Users receive confirmation of successful redemption

- Transaction details are verifiable on-chain

Key Requirements & Notices

To ensure a smooth redemption process, please review the following requirements and notices:

Requirements

- Supported Base Assets: Redeeming DUSD is currently available for USDT and USDC. Additional base assets may be introduced in the future.

- Web3 Wallet: Ensure you have a Web3 wallet and a small amount of SOL to cover network fees.

- Minimum Redemption Amount: The minimum redemption amount is 10 DUSD to ensure efficient system processing.

Notices

Protocol Fees

- A protocol fee is applied to each redemption and is deducted from the redeemed amount. The fee accounts for:

- Network Transaction Fees: To cover blockchain transaction costs.

- Position Open/Close Fees: To manage the hedging positions associated with DUSD.

- The exact fee is subject to market conditions and will be displayed before you confirm the redemption.

7-Day Lock Period

- After initiating a redemption request, your base assets will be released to your wallet after a standard 7-day processing period. This allows the protocol to unwind hedging positions and manage collateral effectively.

Conversion Before Fees

- USDT: DUSD is redeemable at a 1:1 ratio with USDT before protocol fees are deducted.

- USDC: The actual USDC redemption amount is calculated at the moment of redemption based on the prevailing market interest rate.

Automatic Eligibility

- All DUSD, regardless of whether it was minted, purchased from a DEX/CEX, or received from another user, is eligible for redemption.

The redemption process is built on a robust and transparent system, ensuring that your assets are safe and accessible at all times.

Security Measures

Role-Based Access Control

The redemption process is secured through a multi-role system:

- ADMIN: Controls system parameters and role management

- GATEKEEPER: Can pause redemptions in emergency situations

- GATEWAY: Verifies transaction parameters and signatures

Smart Contract Security

- Regular security audits by leading firms

- Time-locked upgrades for critical changes

- Automated monitoring for suspicious activities

- Emergency pause functionality

FAQ

1. What happens during the 7-day lock period?

The 7-day lock period allows the protocol to unwind its hedging positions and manage collateral efficiently. This ensures the system remains stable and fully collateralized. After the lock period, your base assets, minus protocol fees, will be sent to your wallet automatically.

2. Can I redeem DUSD I bought from a DEX or anywhere else?

Yes, you can redeem DUSD regardless of where it was acquired. As long as you hold DUSD in your wallet, it is eligible for redemption at a 1:1 ratio with base assets before fees.

3. Are there any fees for redeeming DUSD?

Yes, a protocol fee is applied to each redemption. This fee accounts for:

- Network transaction fees.

- Position open/close fees to manage hedging positions.

The fee is subject to market conditions and will be displayed before you confirm the redemption.

4. Is there a minimum amount required to redeem DUSD?

Yes, the minimum redemption amount is 10 DUSD to ensure efficient processing and system performance.

5. How long does it take to receive my base assets?

The standard lock period for redemption is 7 days. After this period, your base assets, minus protocol fees, will be automatically transferred to your wallet.

6. What happens if I change my mind after initiating a redemption request?

Once a redemption request is submitted, it cannot be canceled as the system immediately begins processing the unwinding of collateral and hedging positions.

7. Can I redeem DUSD partially or all at once?

Yes, you can redeem any amount of DUSD, as long as it meets the minimum redemption requirement of 10 DUSD. You can choose to redeem in full or in smaller portions based on your needs.

8. Is DUSD always redeemable at a 1:1 ratio?

Yes, each DUSD is fully backed and redeemable at a 1:1 ratio with base assets (e.g., USDT) before protocol fees are applied.